Was It a Glitch or Human Error? How a Code Made My Hospital Stay Unpayable

In March 2025, I walked into Ascension St John Hospital’s emergency department experiencing a terrifying set of symptoms: visual snow, involuntary muscle spasms, hot flashes, a racing heart, and tingling in my limbs. Though I could walk and talk, my body was overwhelmed. I was evaluated and placed under observation while the doctors tried to determine what was happening.

I was given muscle relaxers and Ativan, neither of which resolved my symptoms. I was told I would receive an EEG to rule out neurological causes. No one ever explained to me or my wife that I might be admitted under “observation” status — a classification that would later become critical to my insurance claim.

Weeks later, I received an Explanation of Benefits from my insurance provider stating that it would not cover the observation stay — nearly $7,000 worth of services. I haven't received a direct bill from the hospital yet, but if this denial holds, I likely will.

This is the story of how a hospital visit — one I barely understood while it was happening — left me potentially responsible for thousands of dollars. And I’m not alone.

What the Records Say

During this hospital stay, neither my wife nor I were informed by hospital staff that the observation stay could be classified as non-emergency or that it might not be covered by insurance. Although my wife was present, she lacked specialized medical or insurance knowledge, and hospital personnel failed to communicate potential financial liabilities clearly. Moreover, the medications administered—particularly Ativan (lorazepam) and muscle relaxants—significantly impaired my cognitive functioning, preventing informed consent and understanding of the financial implications of hospitalization.

It's also important to note the cognitive impact of the medications I was administered. Medical literature confirms that benzodiazepines like Ativan (lorazepam) can impair short-term memory, decision-making, and alertness, especially when combined with muscle relaxants, which also cause sedation. In acute settings, these effects may limit a patient's ability to understand medical options or give informed consent. At the time, I was under the influence of both medications — a state in which I could not have reasonably evaluated whether to stay, be admitted, or understand the financial ramifications of the observation status.

My hospital records reflect that the attending physician, Dr. James R. Kelly, noted:

"However, given the patient's tingling, spasming/episodes of tremors, and no clear etiology or cause of the symptoms, the decision was made by myself and my attending doctor to admit the patient to CDU for neurology consultation."

He also wrote:

"Concerns I have would be possible cervical spinal nerve irritation or disc herniation..."

Despite these medical concerns, my admission was coded as non-emergency — the reason my insurance declined to pay for the stay. The EEG that was ordered was covered, ironically affirming the necessity of at least some part of my care.

Diagnosed, But Still at Risk

As I was preparing to leave the hospital, I remember already feeling anxious — not just about my health, but about whether this would be seen as legitimate in the eyes of my insurance. I had disclosed that I had a history of anxiety, and I couldn’t shake the fear that this honest admission would bias how my symptoms were interpreted or coded. Would they reduce it to “just anxiety”? Would a more serious condition be overlooked or minimized? That worry, unfortunately, turned out to be well-founded.

What makes this even more baffling is that two weeks before this ER visit, I had finally received official diagnoses that explained years of confusing symptoms:

Cervical lordosis, a spinal curvature that can cause nerve irritation and neurological symptoms.

Mal de dé barquement syndrome, a rare neurological condition that causes motion instability, dizziness, and cognitive effects.

Neither of these conditions was clearly acknowledged or integrated into my care plan during my ER stay — and certainly not into any conversation about coverage or classification.

Medical Debt in America: A Broader Crisis

How Insurance Responded

While the hospital has not yet billed me directly, the Explanation of Benefits (EOBs) from Blue Cross Blue Shield are already illuminating how fragmented and confusing this process is.

Here’s a summary of charges:

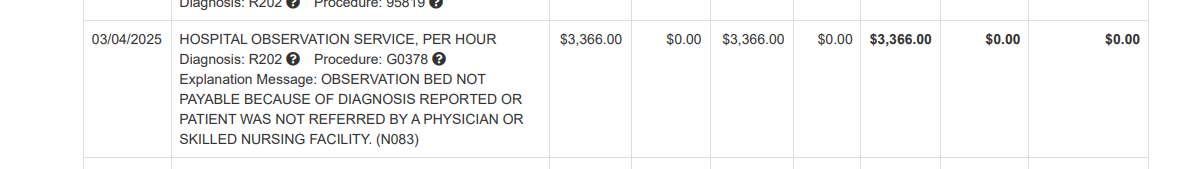

Hospital observation stay (facility charges): $6,896.42 — denied as non-emergency care.

EEG procedure: Covered in full, indicating medical necessity was recognized.

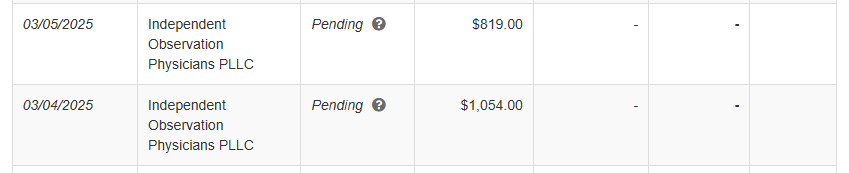

Independent Observation Physicians PLLC charges:

03/04/2025 — $1,054.00

03/05/2025 — $819.00

Both marked as Pending, not yet processed or approved by insurance.

In total, I could be on the hook for over $8,700 if these denials and pending statuses turn into bills — all for a visit during which I was never fully informed about the classification or coverage implications.

These charges span multiple providers and are broken into separate billing streams, which makes it incredibly difficult for a patient to understand who’s billing what, why, or how it all connects. According to the U.S. Bureau of Labor Statistics, the average annual wage in the Detroit-Warren-Dearborn metro area is approximately $66,798, while the median annual wage is only $56,610—and these figures do not include taxes. For a worker earning the median wage, a charge of $8,700 would account for over 15% of their total pre-tax income. For those in the bottom 25% of earners, the burden would be even greater, approaching or exceeding 17% of annual earnings. A bill of this size could easily equate to one or more months of income, making it a potentially devastating event for a large portion of the population, especially those already living paycheck to paycheck. My story is just one thread in a much larger fabric.

According to the Consumer Financial Protection Bureau (CFPB):

About 1 in 5 Americans has medical debt in collections.

As of June 2021, Americans held $88 billion in medical debt on their credit reports.

Medical debt is more frequently disputed than other types — 6% of medical collections are flagged as disputed, compared to just 2% of non-medical ones (Federal Register, 2025).

A Commonwealth Fund study cited by RISE Health found:

45% of insured adults received an unexpected medical bill.

17% were denied insurance coverage for recommended treatment.

I now understand how this happens: patients are placed under "observation" without being told what that means, and coding decisions are made behind the scenes — later becoming the basis for insurance denials.

AI Is Coding Your Medical Bills Now

After pouring through the medical records, I got to thinking: How does this even happen that often? And then I remembered: yes, humans make mistakes. But, so does software and, to me, this all seemed a bit like a really dumb if-else statement that doesn’t dare go too many layers deep.

Recent research in the New England Journal of Medicine AI examined how large language models (LLMs) perform on medical billing code generation. The study found that no model had an exact match rate above 50% for ICD-9-CM, ICD-10-CM, or CPT codes, which renders these tools unsuitable in their base form for use in medical billing (NEJM AI, 2024). While the models could often generate codes that were conceptually similar, they frequently overgeneralized or fabricated specificity, failing to meet the precision standards required for clinical use.

The researchers observed that LLMs lack a full internal representation of coding rules and have difficulty executing multi-step logic — especially without human oversight. They concluded that unless these models are supported by fine-tuning or human-in-the-loop processes, their outputs cannot be relied upon for billing decisions. Notably, the study did not evaluate model performance using real-world EHR data or actual hospital billing narratives — which makes case studies like mine even more important for illustrating real-world implications.

And all of this is happening in an increasingly consolidated healthcare landscape. In October 2024, it was announced that seven Ascension Michigan hospitals and 17,000 employees would become part of a joint venture with Henry Ford Health. According to reporting from The Detroit News, this new organization will control more than 40% of the Metro Detroit hospital market by revenue, bringing in an estimated $12 billion annually and operating across 550 care sites (The Detroit News, 2024). This kind of consolidation raises concerns about diminishing patient choice, unchecked pricing power, and weakened accountability — especially when paired with opaque billing systems and automated claims. In November 2024, The Detroit Free Press also reported that McLaren Health Care acquired Park Medical Centers, a group of 10 primary care clinics in Detroit and surrounding suburbs, with plans to double in size (Free Press, 2024). McLaren is a major healthcare system, and this continued expansion reinforces how a few large entities are rapidly absorbing smaller providers and reshaping access, competition, and pricing across the state. A 2023 report from The Detroit Free Press revealed that if recent proposed mega-mergers are completed — including the Henry Ford and Ascension Michigan deal — as much as 59% of the statewide hospital market share would fall under just three health systems (Free Press, 2023). This consolidation gives hospital systems immense leverage over private insurers and suppliers, but it also reduces patient choice and limits competitive pressures that might otherwise lower costs or improve quality.

The article also noted:

The 2022 Spectrum-Beaumont merger formed Corewell Health, a 21-hospital system with more than 60,000 employees and 1.3 million insurance members via Priority Health.

Earlier in 2023, University of Michigan Health merged with Sparrow Health to create a $7.8 billion network across 11 hospitals and 46,000 employees, which also includes Sparrow's insurance offerings.

In reviewing my own medical records, I found that the “First Impression” and “Reason for Visit” sections included phrases like "diffuse paresthesia," "involuntary shaking," and "tingling in extremities." These are symptoms that clearly point to neurological distress. However, according to Blue Cross Blue Shield, the claim was denied because these were interpreted as “skin conditions” — and therefore not considered emergent.

This raises serious questions about how impressions are actually coded in these systems. Despite all other ER-related charges being covered, the observation stay tied directly to these symptoms was denied. What seems to be missing from the coding process is context. Did a human simply rush through the records and assign a code without reading the doctor’s narrative? Or was it a poorly written piece of software — using oversimplified heuristics — that scanned for keywords and misclassified serious neurological symptoms as superficial?

The opacity of this process is part of the problem. I don’t know for certain whether software was to blame for this denial. It could have been the result of a poorly written or overly simplistic algorithm, or it might have been a rushed or overwhelmed billing department employee who misread or overlooked the doctor’s full notes. Either way, the system currently lacks the safeguards to catch or correct errors — and the patient is left to deal with the consequences. Patients are left guessing whether their care was denied because of human error, software limitations, or lack of communication between departments. What’s especially frustrating is that while hospitals and insurers are leveraging software to gain efficiency and maximize claim submissions — theoretically a way to reduce overhead and improve outcomes — patients rarely see those benefits in the form of lower prices or better care.

Instead, when automated systems misclassify care, the errors scale faster, and the profits increase for large health networks. But patients? We get stuck with the bill — often alone, unless we have legal support, medical literacy, or the time to wage a personal appeals process.

We can’t even count on market forces to bring relief. Most hospitals are now part of massive networks owned by a small number of conglomerates. Insurance companies function like oligopolies, offering limited transparency or accountability. As of 2023, just four health insurers control 50% of the U.S. market, with six companies accounting for 30% of all healthcare spending. Mergers such as CVS Health with Aetna, Cigna with Express Scripts, and Kaiser Permanente with Geisinger have bolstered profits but, in some cases, have also led to increased premiums for consumers (Yahoo Finance, 2023). Blue Cross Blue Shield remains one of the largest players, structured as a federation of companies that maintain significant market power. And the government, despite paying a large portion of the nation's medical bills through public programs, continues to absorb and normalize rising costs — costs that are ultimately passed on to taxpayers and patients alike. What if I told you that the first pass at billing your hospital visit might not involve a human at all?

Research shows that hospitals are increasingly using AI and machine learning to code medical procedures and submit claims. These tools are efficient but not foolproof:

A University of Michigan study found AI models could classify billing codes with up to 96.8% accuracy — but that still leaves room for error.

Another study cited in MedTech Intelligence reported that AI systems reduced coding errors by 35%, but did not eliminate them.

No system is perfect. And it’s unclear whether hospitals are reviewing these algorithm-generated codes with human eyes — or whether they rely on patients to catch mistakes after the bill is denied.

What Needs to Change

Hospitals should also be required to provide patients with a clear, itemized estimated cost breakdown prior to discharge — including:

What was billed to insurance,

Why each charge was coded the way it was,

And what portion the patient may be expected to pay, whether in cash or through insurance.

Hospitals already use sophisticated tools such as barcode scanning, geotracking of patients and supplies, and digital charting systems that precisely record care delivery. With this infrastructure in place, generating automated cost summaries at the time of discharge should be a standard expectation — not a luxury. Patients should also have the right to challenge the cost estimate before it is submitted to insurers, adding a critical layer of accountability and error prevention.

We also need legislative action at both the state and federal levels. If hospital systems and insurance companies are permitted to use software to automate claims, there must be a legally mandated right for patients to have at least one human review their claim — without having to ask for it. After any denial, patients should be clearly shown evidence that such a human review was conducted.

Additionally, insurance companies should be required to publicly report:

The total number of denied claims, and

The percentage of those denials that were reviewed by a human before being issued.

Without transparency or mandated oversight, the default remains silence, misclassification, and overwhelming administrative burden — placed squarely on the patient.

A Maze of Misdirection

Navigating this situation has demanded far more time and effort than most patients can afford. I’ve had multiple phone calls with both the hospital and Blue Cross Blue Shield, consulted family members in the medical field, and sent formal letters to the Director of Quality, the Chairman of the Board, and the Billing Department at Ascension St. John. Even with those resources and background, the process has been exhausting, with no clear roadmap or single point of resolution.

The appeals process is so opaque and fragmented that patients often don’t know who to call, whether their request is being reviewed, or what recourse exists if they are ignored. Most people don’t have medical knowledge, legal expertise, or hours of free time to fight for fairness. That’s not just frustrating — it’s fundamentally unjust.

I attempted to get clarity. I first called the Ascension St. John Detroit Customer Service line, where I was told their department "does not talk to the doctors" who generate the documentation that determines the codes used in billing. They directed me to call the ER directly to ask them to change the code. When I called the ER, an employee seemed confused why billing had referred me to them. I left a message, as instructed — but no one ever called me back.

I then reached out to Blue Cross Blue Shield, who told me they couldn’t assist either, because: “We can only pay or not pay based on what the doctors code in the bill.” Eventually, it took another employee at Ascension St. John to even suggest something called a “code review.”

That’s how this system works: multiple silos, no clear communication, and a total absence of accountability when things go wrong. If I hadn’t had the time, energy, and resources to keep calling, I would have simply been billed for nearly $9,000 — and expected to pay it. We need basic transparency:

Clear notice to patients when their care may fall under "observation" status.

An explanation of how coding decisions are made and how they affect insurance claims.

Oversight of AI and automation in billing — especially when those systems are not 100% accurate.

I’ve already sent letters to the hospital board, to MDHHS Director Elizabeth Hertel, and to investigative journalists. This story isn’t just about me — it’s about what happens when automation meets opacity, and patients are left footing the bill.

If You’ve Been Affected, Speak Up

Have you received an unexpected medical bill? Were you denied coverage after a hospital stay? I want to hear from you.

📣 Share this article and tag local journalists or policymakers.

💬 Use your voice — it may be the only way this system changes.

References

Curran, H.V. (1986). Tranquillising memories: a review of the effects of benzodiazepines on human memory. Biological Psychology, 23(2), 179–213. https://doi.org/10.1016/0301-0511(86)90066-8

U.S. Food and Drug Administration. (2016). Lorazepam (Ativan) Prescribing Information. Retrieved from https://www.accessdata.fda.gov/drugsatfda_docs/label/2016/017794s045lbl.pdf

Bureau of Labor Statistics. (2023). Occupational Employment and Wage Statistics for Detroit-Warren-Dearborn, MI. Retrieved from https://www.bls.gov/oes/current/oes_19820.htm

NEJM AI. (2024). Evaluating the Capabilities of Large Language Models in Automated Medical Coding. Retrieved from https://ai.nejm.org/doi/full/10.1056/AIdbp2300040

Yahoo Finance. (2023). Largest health insurance companies control half of U.S. market. Retrieved from https://finance.yahoo.com/news/largest-health-insurance-companies-control-120000056.html

Free Press. (2023). Michigan hospital mega-mergers concentrate market power in few health systems. Retrieved from https://www.freep.com/story/news/health/2023/11/16/michigan-hospital-mega-mergers-corewell-henry-ford-university-michigan/71476024007/

Free Press. (2024). Park Medical Centers’ new McLaren ownership part of expansion strategy. Retrieved from https://www.freep.com/story/money/business/2024/11/27/park-medical-centers-new-mclaren-ownership/76567450007/

The Detroit News. (2024). Seven Ascension Michigan hospitals, 17,000 employees join Henry Ford in joint venture. Retrieved from https://www.detroitnews.com/story/news/local/michigan/2024/10/01/seven-ascension-michigan-hospitals-17000-employees-join-henry-ford-in-joint-venture/75467168007/

Consumer Financial Protection Bureau. (2022). Medical Debt Burden in the United States. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_medical-debt-burden-in-the-united-states_report_2022-03.pdf

Federal Register. (2025). Prohibition on Creditors and Consumer Reporting Agencies Concerning Medical Information. Retrieved from https://www.federalregister.gov/documents/2025/01/14/2024-30824/prohibition-on-creditors-and-consumer-reporting-agencies-concerning-medical-information-regulation-v

RISE Health. (2022). Millions of Insured Americans Face Unexpected Medical Bills, Coverage Denial. Retrieved from https://www.risehealth.org/insights-articles/millions-of-insured-americans-face-unexpected-medical-bills-coverage-denial/

PMC. (2022). Using Machine Learning and Natural Language Processing to Classify Anesthesiology CPT Codes. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC11216662/

MedTech Intelligence. (2022). AI and Human Oversight: A New Era in Reducing Medical Billing Errors. Retrieved from https://medtechintelligence.com/feature_article/ai-and-human-oversight-a-new-era-in-reducing-medical-billing-errors/

Tags#: medical billing errors, ER visit insurance denial, healthcare transparency, insurance claim denial, hospital coding practices, AI in healthcare, healthcare consolidation, patient advocacy, health policy reform, surprise medical bills, emergency room misclassification, healthcare AI risks, denied ER claims, insurance billing disputes, hospital revenue cycle management, healthcare accountability, medical debt crisis, CPT code disputes, health tech ethics, broken healthcare system